Buy

and sell gold

A safe haven

accessible to all

Why

buy gold?

Gold has since been considered a safe haven.

Whether marking an occasion with a valuable gift, preparing for the future, passing on assets, or protecting part of one’s savings, it represents a safe, flexible, and accessible choice for all.

It’s also a precious gift, ideal for a baptism, wedding, birthday, anniversary, or any other special occasion.

Sell your gold with

complete peace of mind

Do you own coins, bars, or small ingots you’d like to sell?

We offer a free appraisal and favorable buyback conditions all with full transparency.

Gold bars and small ingots

You may be subject to gold taxation. Our experts are here to guide you and help you choose the most advantageous option.

5 g

10 g

1 Oz

100 g

250 g

500 g

1 kg

Gold coins

Discover our selection of gold coins perfect for a secure investment or a timeless gift.

20 francs

Napoléon

20 francs

Suisse

Souverain

Souverain

Elisabeth II

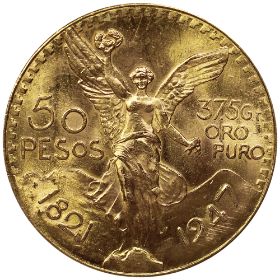

50 pesos

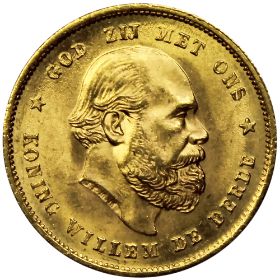

10 florins

Hollandais

Optimize gold taxation

You may be subject to gold-related taxes. Our experts are here to guide you and help you choose the most advantageous option.

No proof of purchase?

Here’s what you need to know

In the absence of proof of purchase, a flat tax of 11.5% applies to the sale price of your gold.

Gold held for over 22 years:

benefit from tax exemption

If you have owned your gold for more than 22 years and can provide documentation proving the holding period, you are exempt from tax. Simply complete form 2092 SD, provided by the BNC (non-commercial profits authority). We are available to assist you in completing the declaration.

A favorable regime

in the event of a capital gain

Subject to the capital gains tax regime (36.20%*). Tax applies only to the actual capital gain — no tax is due in case of a capital loss. The gross capital gain or loss is calculated as the difference between the sale price and the purchase price. A 5% annual allowance applies starting from the 3rd year, gradually reducing the taxable amount.